About Japanese CSOs

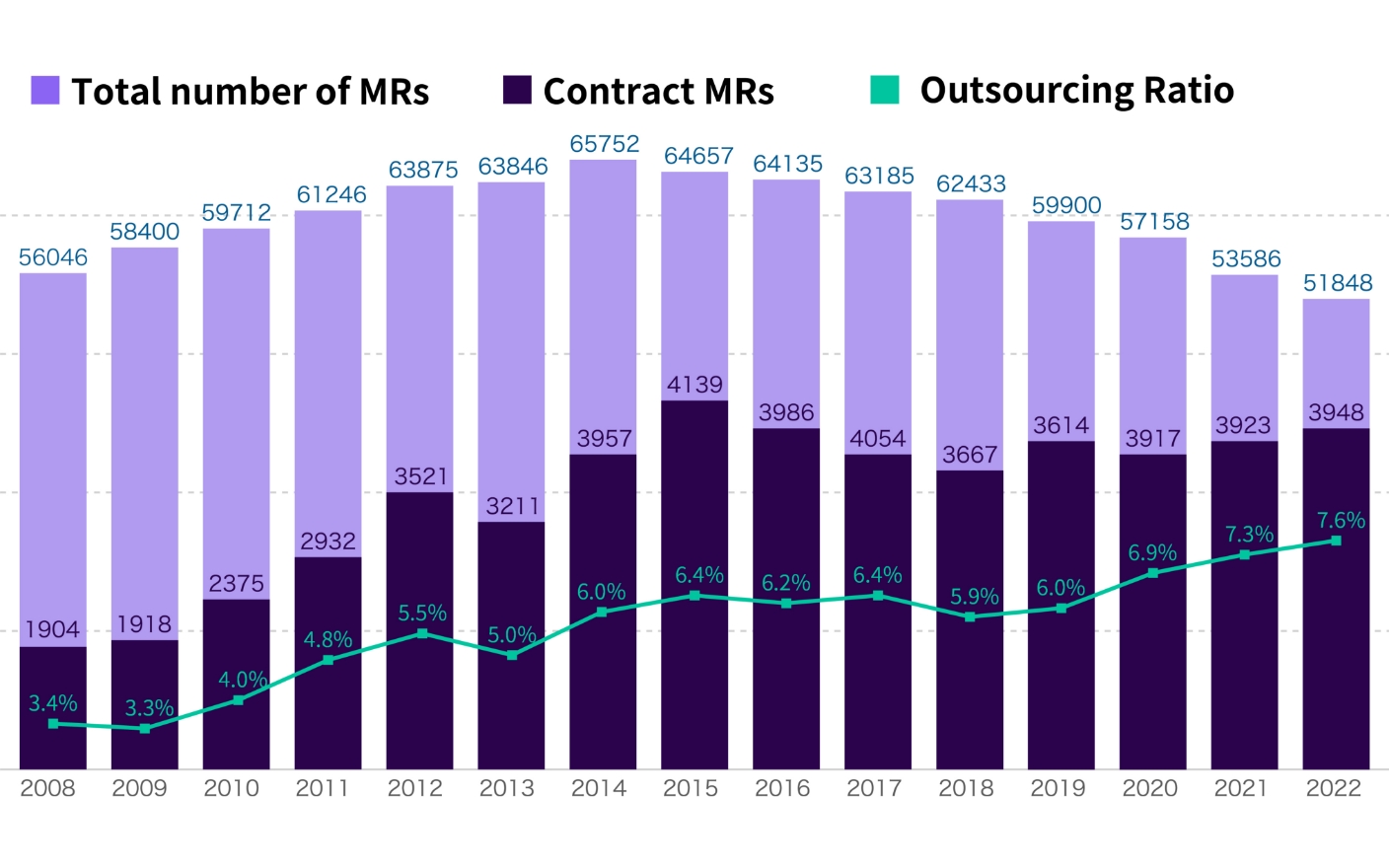

In Japan, contract MR services have been in place since 1998 and today there are approximately 4,000 professional MRs in operation throughout the country.

There are 14 companies operating CSO businesses in Japan, with the majority of contracted MRs belonging to the five member companies of the Japan CSO Association, established in 2011.

The number of MRs belonging to CSOs now accounts for 8.9% of all MRs in the country and we expect this number to continue to grow.

Source: MR Education & Accreditation Center of Japan, "MR White Paper - Survey on the Actual Conditions and Education and Training of MRs" (2008-2022).

We estimate that almost all of the top 30 companies in terms of domestic ethical pharmaceutical sales have implemented CSO services. In addition to these large companies, the use of CSOs in smaller pharmaceutical companies, such as bio start-ups, has also led to the growth of CSOs in Japan.

The services of domestic CSOs have developed mainly around human resources services. On the other hand, in the course of its quarter of a century history, it has acquired a wide range of experience and each of the CSO companies now offers a diverse range of services, each with its own specific characteristics.

Areas Served

- Sales

- Marketing

- Medical Affairs

- Human Resources Development

Human Resource Services

- MRs

- Nurse Educators

- MA/MSLs

- Medical Device Sales Representatives

- etc.

Consulting Services

- Organizational start-up

- Operational streamlining

- Human resource capacity building

MR in Japan

Sales and Distribution System in Japan

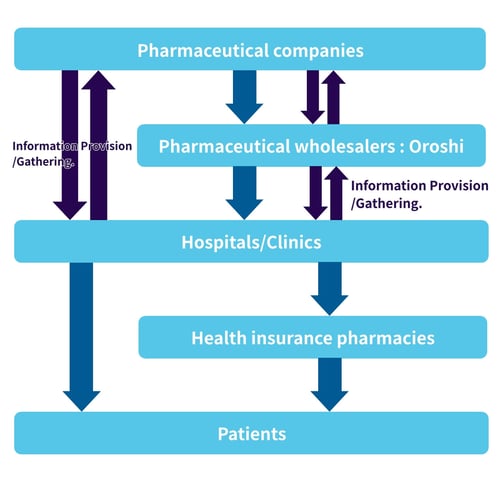

Almost all ethical pharmaceuticals in the country are distributed via pharmaceutical wholesalers (called “Oroshi” in Japanese). Japanese Oroshi are responsible for purchasing, storage and quality control, delivery, as well as negotiating prices and providing some information to healthcare facilities. Japan's unique way of providing information is based on this system.

Role of MRs in Japan

The main roles of the MRs include the following:

- Visiting healthcare facilities (hospitals, clinics, pharmacies, etc.).

- Providing information based on package inserts (in person or remotely).

- Collecting and reporting information on efficacy and safety.

- Conducting information sessions in healthcare facilities.

- Managing lectures (*organized by pharmaceutical companies).

- Visiting exclusive distributors (Oroshi) (sharing information with MS).

Attributes

- University graduates (more than half with a liberal arts background) *The proportion of graduates with a science background is increasing.

- Majority of MRs are males *Female MRs are considered increasing.

- Less than 10% of all MRs have pharmacist qualifications.

- Less than 1% of all MRs work full-time remotely (telephone and web interviews only).

- MRs belong to a legal entity (pharmaceutical company or CSO).

- In principle, MR certification is mandatory (see below).

Job Characteristics

- There are no price negotiations, no sales contracts, and no deliveries (sales contracts and distribution are carried out by the pharmaceutical Oroshi).

- Pharmaceutical companies have responsibility for collecting and reporting safety management information, including information on adverse drug reactions, and this practice is mainly carried out by MRs.

- Information is provided primarily to doctors, but also to nurses, pharmacists and other healthcare professionals.

- With a few exceptions, the majority visit their area of responsibility in a sales vehicle.

- With a few exceptions, they often move to a different area of responsibility every few years.

- MR activities are often constrained by legislation, official guidelines, industry association guidelines, company promotion codes etc.

- In relation to the above, MRs do not produce information-providing materials.

- Due to stricter regulations on the part of medical institutions regarding MRs' visits to institutions, more and more medical institutions are introducing appointment systems.

- The number of calls per MR has tended to decrease in conjunction with the restriction of visits due to Covid-19.

MR Accreditation Scheme

In Japan, the private MR Education & Accreditation Centre of Japan is the only organization dedicated to certifying MRs. Although it is not a prerequisite for employment as an MR, it is practically mandatory to obtain this qualification. Certification is awarded after a minimum of six months’ work experience, in addition to completing a prescribed program and passing an examination.

The MR Education & Accreditation Centre of Japan allows individuals to take the exam prior to employment, but in the majority of cases, the pharmaceutical or CSO company in which they are employed provides the training for the certification.

In order for a company to be able to provide the basic introductory training to qualify as an MR, it has to meet the standards set by the Centre and become a registered company. Registered companies are responsible for the procedures for issuing certificates to their MRs, conducting and managing ongoing training and renewing registration.

Why Are There So Many MRs in Japan?

It is believed that the large number of MRs in Japan can be attributed to a variety of reasons. The main factors are described below:

- Strict regulation of promotional activities to patients and high importance of providing information to healthcare professionals

- Given that only doctors are allowed to prescribe drugs, the value of informing doctors directly is high

- There are a large number of medical facilities: about 8,000 hospitals and 100,000 clinics and other institutions.

- Doctors are busy: The number of doctors is small compared to the number of hospitals, and doctors work unusually long hours. Doctors' busy schedules limit their time to gather information.

- Failure to embrace digital environments in healthcare facilities has resulted in face-to-face detailing becoming the norm.

- The number of MRs swelled in the early 2010s with the launch of a number of blockbuster drugs for lifestyle diseases, and it has been difficult to reduce the number of MRs to remain competitive with other companies.

- In the medical field, the share of voice style visits by MRs has gained ground.

- There was a high level of trust from doctors as a channel for information and it was necessary to respond to their needs.

- Various digital channels are being used, but MRs still play an important role in the process of reviewing and deciding whether to change prescriptions.

In recent years, however, large-scale reorganizations and other measures to reduce the number of MRs have become more common, and the total number of MRs has tended to decrease, as shown by the trends in the number of MRs mentioned above.

CSO Services: Dispatching and Outsourcing

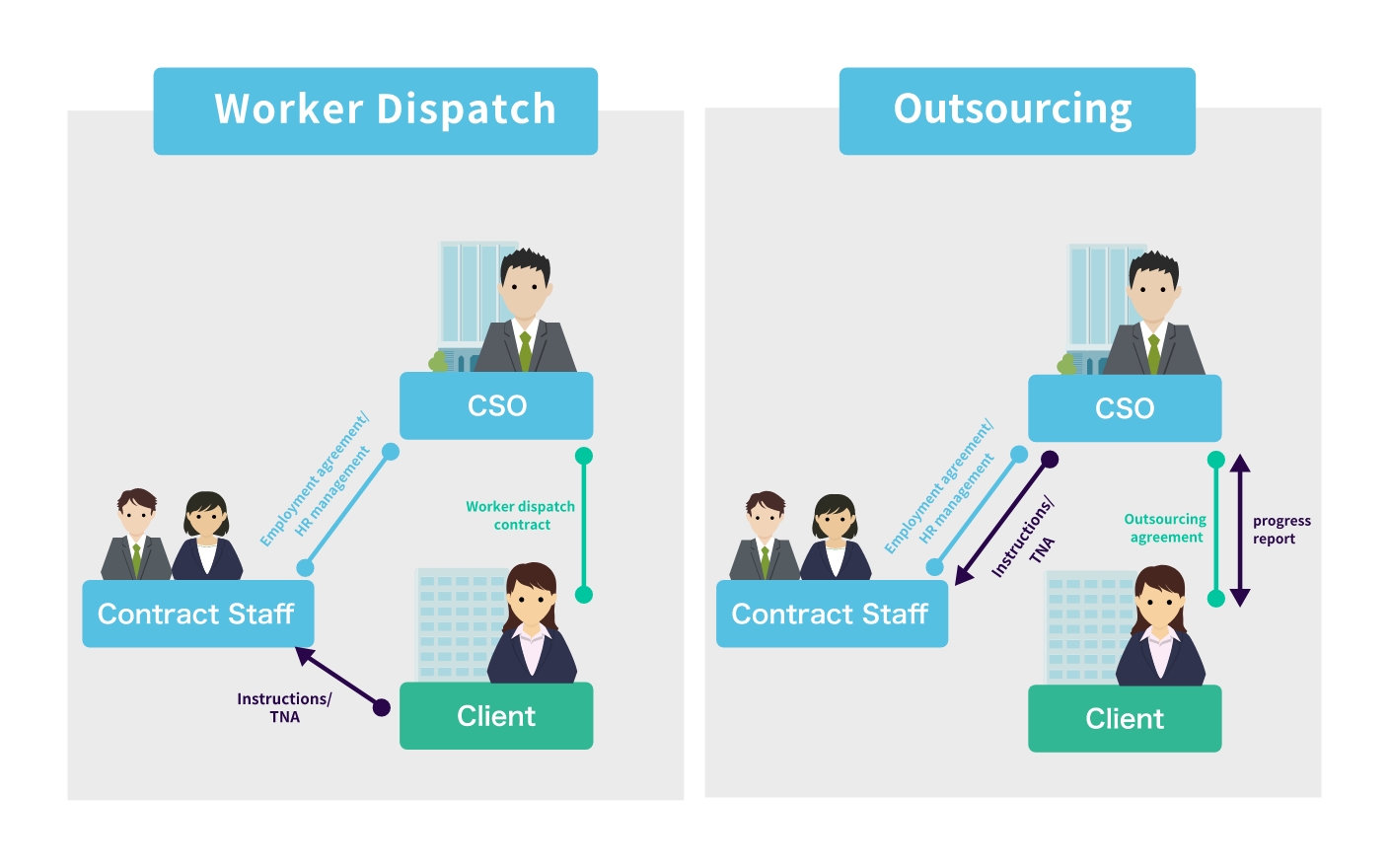

In Japan, there are two main patterns of human resource services in CSOs: dispatching and outsourcing, with dispatching accounting for 80%. They are often used by large pharmaceutical companies, for example, when they have already set up a sales organization and a management structure and are bringing in contract sales MRs as a complement to their staff.

However, it is important to choose a partner with sufficient knowledge and experience to comply with Japanese labor dispatch laws, which are complicated and strict.

Outsourcing is increasingly used for piloting new initiatives, in the start-up phase of sales forces, and for sales force management in small pharmaceutical companies, as it is relatively unregulated and flexible, although the number of outsourced operations is small.

The CSO companies propose contractual arrangements that are appropriate to the specific challenges faced by the pharmaceutical companies.

Contract MR Services with Personnel Dispatch

- Project size varies from 1 to over 100 staff.

- Most of the contracts are for a period of about two years.

- All disease areas, from primary to specialized, are covered.

- Depending on the needs of the client, it can also be limited to a specific geographical area.

- In addition to MRs, there are also staffing services for various professions, such as educational nurses and MSLs.

- To co-ordinate information within the project team, a manager is assigned to each project.

Implementation Schedule and Costs

In the case of personnel dispatch services, if the sales organization and management structure are already in place, the preparation time for implementation is around 3-6 months after the contract is awarded, whereas if the introduction of a CSO is completely new, more time is needed to prepare for acceptance of the staff. In the case of outsourcing, on the other hand, the implementation period varies greatly depending on the scope of the work being outsourced. In our experience, it takes about a year to prepare a case from the start of a sales organization.

Early consultation with the CSO company's sales representative is recommended, as costs vary depending on the type and duration of implementation preparation.

Service Search

You can find out more about what we offer here

Japanese Customs

Features of the Japanese Healthcare Environment

- Universal health insurance system.

- More than half of the medical institutions are privately owned.

- Doctors have a great deal of discretion and medical staff have a limited amount of discretion.

- The Japanese are very health-conscious, but take little ownership of their treatment (patients also tend to be dependent on their doctors).

- The concept of a family doctor is not widespread and patients are free to see any doctor they like.

- Workplace reform for doctors will start in 2024.

- Formulary is still in the implementation phase.

- Rapidly aging society.

- There is great complexity in the networks between hospitals.

Pharmaceutical Industry Environment

- As is the case in Europe, the price of medicines is set by the government.

- Continued downward price trend due to annual NHI price revisions.

- The approval process is time consuming and drug lags continue to be an issue.

- The process of obtaining a manufacturing and marketing authorization is usually time-consuming and cumbersome.

- Generics have a penetration rate of around 80%.

- The government's reform of the health care system and the promotion of innovation in the pharmaceutical industry.

- Digital use is becoming more active, albeit belatedly.

Employment Practices

Although Japan's legal restrictions on dismissal are considered to be on a par with European countries, the country is based on long-term employment and job-based employment has not taken root. As a result, a very high level of objectively reasonable grounds and logical reason based on social convention is required to dismiss an employee. Careful decisions are required when recruiting new staff on a permanent basis.

Conclusion

There are a number of considerations when setting up a distribution structure in Japan and it is important to have a partner who is well versed in the laws and industry regulations.

Preparation of Systems for Compliance with the Legal and Regulatory Requirements of the Japanese Market

- GVP/GPSP compliance, adherence to ethical pharmaceutical promotion codes, fair competition codes for ethical pharmaceutical manufacturing and marketing, and compliance

- Development of safety management information system, quality assurance system, distribution system, compliance department, sales system, etc.

Development of Marketing Strategies and Optimal Allocation of Resources that are Appropriate for the Japanese Market

- On-site requirements and business practices in the Japanese medical field: Dealing with Japan's unique medical office system and KOLs, and dealing with exclusive distributors

- Optimal touch points for doctors, medical staff and patients: in-person and online interviews, use of third parties, lectures

- Optimal allocation of resources according to geographical conditions: distribution between metropolitan areas and specialized facilities

- Culture, Customs

Preparing and Managing Diverse Human Resources

- Securing the human resources to deliver the sales strategy: MRs, Managers and Trainers.

- Labor Management Systems, MR Accreditation Management, Sales Effectiveness Measurement, Safety Information Management, etc.

Review System, NHI Price Revision, and Market Changes

- Ensure organizational flexibility to respond to unforeseen events

CMIC Inizio Supports Your Success

CMIC Inizio is part of Inizio Engage, which supports a wide range of global pharmaceutical and other market launches.

- Implementation and pilot operation of global marketing strategy in Japan

- From contract sales to creating a self-distribution system

- Establishment of a medical affairs system

- Support for business activities that promote patient centricity, etc.

We can make the best recommendations based on our global knowledge of how to build and strengthen relationships between life sciences and healthcare companies and healthcare professionals and patients, including the ones mentioned above.

CMIC Inizio is also a member of the CMIC Group, which offers a wide range of services in Japan, from research and development to manufacturing and sales.

- Setting up a Japanese legal entity

- Marketing Authorization Holder (MAH) application

- Pharmaceutical applications and so on

All processes can be serviced by co-operating with the various functions of the CMIC Group.